Do Spouses of 100% Disabled Veterans Get Benefits?

The spouse of a veteran with a 100% disability rating may be entitled to certain direct benefits, including healthcare coverage and educational assistance. The veteran is also entitled to additional monetary VA Disability benefits for the spouse and for other eligible dependents. Here’s what you need to know about what may be available to the spouse of a 100% disabled veteran.

Add-On VA Disability Benefits for Spouses

The increase in monthly monetary disability benefits for qualifying dependents isn’t a direct benefit to the veteran’s spouse. Instead, the disabled veteran receives an increase in their monthly disability benefits to account for the presence of certain dependents.

Increased benefits for dependents are available to all veterans with a disability rating of 30% or higher. However, like base benefits, the amount added on for each dependent increases with the veteran’s disability rating. For example, in 2025, a disabled veteran with a 30% disability rating who has a dependent spouse will see a $64/month increase in benefits. At a 60% VA disability rating, the same veteran would receive an extra $128/month. And, the veteran rated 100% disabled would see benefits jump by $213.61/month.

A veteran may also receive increased VA disability benefits for other dependents, such as children or dependent parents.

Call 1-888-373-4722 or complete a Free Case Evaluation form

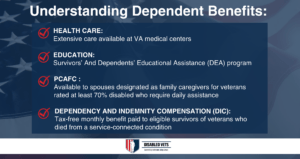

Types of Spousal Benefits

Some spouses of disabled veterans who are rated 100% disabled qualify for additional benefits. That includes veterans who have a VA disability rating lower than 100% but have been deemed totally disabled due to individual unemployability (TDIU). Depending on the circumstances, a veteran may receive a TDIU classification with a VA disability rating as low as 60%. A TDIU designation entitles the veteran to all of the same benefits that would be available with a 100% rating.

However, it’s important to note that there are often other qualifications attached to these benefits. For example, some of the key benefits for spouses of 100% disabled veterans–healthcare and educational benefits–are available only if the veteran’s VA disability rating is permanent.

Other benefits, such as caregiver assistance, are only available based on the needsof the disabled veteran and the role the spouse plays. Still others, such as Dependency and Indemnity Compensation (DIC), have much more complicated criteria.

Healthcare Benefits for Spouses

When a veteran has a permanent 100% disability rating or a permanent classification of total disability due to individual unemployability (TDIU), their spouse may be entitled to healthcare benefits. The Civilian Health and Medical Program of the Department of Veterans’ Affairs (CHAMPVA) operates much like private or employer-based medical insurance.

CHAMPVA coverage has a $50 annual deductible, then the plan pays 75% of your qualifying medical costs. Your share of the cost of most services is 25%, but you won’t always have to pay that amount. For example, if you have other insurance in addition to CHAMPVA coverage, the other policy may cover some or all of your share. And, out-of-pocket expenses are capped at $3,000/year. Once you reach that threshold, CHAMPVA covers 100% of eligible services.

Most medically-necessary services are covered as long as they are provided by a licensed medical professional. However, as with private insurance, you’ll need to ensure that your provider works with CHAMPVA. If you choose a provider that doesn’t accept assignments for CHAMPVA participants, the plan may still cover some of your care. But you may end up paying more than the usual 25%.

Educational Benefits for Spouses

Spouses of veterans with a permanent 100% disability rating or a permanent TDIU classification are entitled to educational benefits through the Survivors’ and Dependents’ Educational Assistance (DEA) program. For most spouses, these benefits must be used within 10 years of becoming eligible. However, in some circumstances, the spouse may have up to 20 years to use these benefits. And, spouses who became eligible on or after August 1, 2023, have no time limit for taking advantage of DEA benefits.

The DEA benefit is a monthly payment to help with the costs of education. Assistance may be available for college, career training certificate programs, apprenticeships, and even on-the-job training. If you started or start school or training on or after August 1, 2018, you may be entitled to up to 36 months of benefits.

The amount of benefits you’ll receive depends on the type of educational program and the number of hours you’re attending. The specific amounts are adjusted annually. The numbers below are from October 1, 2024, through September 30, 2025.

For both college and vocational school programs, DEA recipients will receive:

- $1,536 for each full month of attendance

- $1,214 for each month of attendance at ¾ enrollment or more but less than full-time

- $890 for each full month of attendance at ½ enrollment or more but less than ¾ time

- The lesser of $890 or the cost of tuition for each full month of attendance at ¼ enrollment or more, but less than ½ time

- The lesser of $384 or the cost of tuition for each full month of attendance at less than ¼ enrollment

If you are enrolled less than ½-time and your tuition and fees total less than the amount you would receive monthly, the full amount of tuition and fees will be paid to you in a lump sum at the beginning of the term.

Benefits for apprenticeships and on-the-job training work a little differently. The monthly benefit decreases over time, with the spouse receiving benefits of:

- $975/month in months 1-6

- $733/month in months 7-12

- $481/month in months 13-18

- $245/month in months 19 and subsequent

A spouse’s educational benefits may also be used in part to cover the costs of test preparation courses and licensing exams.

Call 1-888-373-4722 or complete a Free Case Evaluation form

Program of Comprehensive Assistance for Family Caregivers (PCAFC)

PCAFC benefits are not available to every spouse of a 100% disabled veteran. Instead, this program provides support for a spouse who is designated a family caregiver for a disabled veteran with a disability rating of at least 70% who needs day-to-day assistance. Designated family caregivers have access to education and training for caregiving, mental health counseling, and travel assistance when traveling with the veteran for medical care. Some caregivers are also eligible for:

- A monthly stipend

- CHAMPVA medical coverage

- Respite care for the veteran

Call 1-888-373-4722 or complete a Free Case Evaluation form

Benefits for the Surviving Spouse of a 100% Disabled Veteran

If your spouse dies with a 100% disability rating, you may be entitled to Dependency and Indemnity Compensation (DIC). For 2025, the base rate of compensation for a surviving spouse is $1,653.07/month. Under certain circumstances, the spouse may be entitled to additional compensation. For example:

- If the deceased veteran spouse had a 100% disability rating for at least eight years before their death and the surviving spouse was married to them for the full eight years, compensation is increased by $351.02/month

- If the surviving spouse has a disabling condition that necessitates regular help with daily activities, compensation is increased by $409.53/month.

- If the surviving spouse is housebound due to a disability, compensation will be increased by $191.85/month.

Benefits are also increased for each minor child. A surviving spouse with minor children will receive an extra $409.53/month for each child. In addition, a surviving spouse with one or more children will receive $350/month in transitional benefits for the first two years after the veteran spouse’s death.

Surviving spouses of deceased veterans may also qualify for additional benefits, such as home loan programs, financial advice, and career counseling. However, each program has its own requirements. For example, to get a certificate of eligibility for a VA-backed mortgage loan, the surviving spouse must show that the veteran died from a service-connected condition or had been totally disabled before their death.

Make Sure You Get the Benefits You Deserve

If you’re the spouse of a 100% disabled veteran or the surviving spouse of a veteran who met certain qualifications, you may be entitled to benefits directly from the VA. Unfortunately, many people miss out on benefits because they don’t know what they’re entitled to, or because they don’t know how to pursue benefits or fight a denial. A knowledgeable VA disability benefits advocate can be your best resource.

Whether you’re a veteran looking to establish your right to VA disability benefits, a surviving spouse seeking DIC or other benefits, or another dependent who has been denied benefits, Disabled Vets is here for you. Our experienced advocates have a solid understanding of the benefits that may be available to a disabled veteran, the spouse or surviving spouse of a disabled veteran, or other dependents. We also know what is required to qualify for each type of benefit and how to put together a strong claim or appeal.

Having the right guidance can minimize stress, help avoid common mistakes that could delay or derail your claim, and help ensure that you provide the documentation the VA is looking for. To learn more about how we can help, call 888-373-4722 or fill out our contact form here.

Learn More Here:

- How To Apply For VA Disability

- My VA Disability Claim Was Denied. What Should I Do?

- How To File A VA Disability Claim

- VA Disability Ratings

- Mental Disorders and VA Disability

- Most Common VA Claim Types

Call 1-888-373-4722 or complete a Free Case Evaluation form